LETTERS

- Share via

Re: “Redemption still eludes Milken,” Feb. 3:

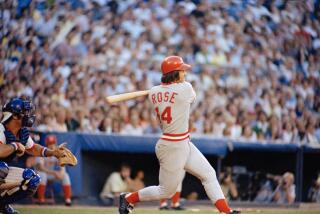

If and when a president pardons [convicted junk bond pioneer, financier and philanthropist] Michael Milken, shouldn’t Major League Baseball also pardon Pete Rose? They’re both gamblers, even if in a different arena and on a different scale. I’m sure if Pete had $350 million to spare, he’d donate it to a worthy cause too.

Marion Claire

Los Angeles

--

It’s absurd to blame Milken for the very problems he warned about. In the late 1980s, Milken repeatedly called for regulatory reform and warned companies and financial institutions to de-leverage their capital structures.

The savings and loans’ problems were caused not by Milken but by unwise real estate loans, federal deposit insurance and regulatory mismanagement. Junk bonds comprised less than 1% of S&L; holdings and thus could not cause the S&L; crisis. Indeed, they were the best-performing S&L; assets in the 1980s.

The ill-conceived Financial Institutions Reform Recovery and Enforcement Act of 1989 forced some S&Ls; to sell their junk bonds. That caused a temporary drop in the junk-bond market -- less than 10% -- in 1990. It roared back 46% in 1991.

Exhaustive academic research shows that contrary to Bill Seidman’s claim, Milken created tremendous economic value that was partially destroyed for some S&Ls; by misguided government action.

James Barth,

former chief economist

U.S. Office of Thrift

Supervision

and

Glenn Yago, director of

capital markets

Milken Institute,

Santa Monica

More to Read

Go beyond the scoreboard

Get the latest on L.A.'s teams in the daily Sports Report newsletter.

You may occasionally receive promotional content from the Los Angeles Times.